(813) 761-3457 (TTY: 711)

Medigap (Medicare Supplement) Plans

What are Medigap (Medicare Supplement) Plans?

Medicare Supplement plans (more commonly known as Medigap plan) cover expenses and costs not covered by original Medicare Parts A and B such as deductibles and co-insurance. Medigap plans can help minimize your out-of-pocket costs for healthcare services. These plans differ from Medicare Advantage (Part C) plans. Our agents are available to assist you with finding the right plan to meet your needs.

How do Medigap Plans Work?

Medicare only covers 80% of your Part A and B expenses. Depending on your healthcare needs, the 20% that you are responsible for can be financially devastating. Medigap supplement plans pay the remaining 20% not covered by original Medicare (Parts A and B).

Medigap plans may many or all of your coinsurance costs for inpatient hospital care, skilled nursing, hospice care and home health services. Medigap plans also pay your $1,556 Part A deductible (in 2022) for every 60-day benefit period.

You will still be responsible for paying your Medicare Part B premium in addition to a Medigap plan premium.

Why Choose a Medigap Plan?

Payment for coinsurance, deductibles and copayments

No referrals needed for specialists

Automatic claims filing

Medigap plans may cover your coinsurance or copayment costs for Part B medical services and medical supplies such as:

Physician Visits

Outpatient Procedures

Durable Medical Equipment

Lab Work

What Should I know Before Choosing a Medigap Plan?

Plans are issued on an individual basis. Your spouse or other family members must be issued a separate supplement policy (this can result in household savings)

Does not cover long-term care, vision, dental care (you may want to consider a Medicare Advantage Part C plan for these types of benefits)

Medigap plans may require medical underwriting depending on when you apply

Does not cover prescription drug coverage (you can add a separate Part D plan)

Enrollment in a Medigap plan includes a 'look back' period in which certain conditions treated in the six months before your plan started are not covered. Your Original Medicare (Parts A and B) will still cover your condition but you will be responsible for the 20% coinsurance and copayment that would be otherwise covered by your Medigap plan.

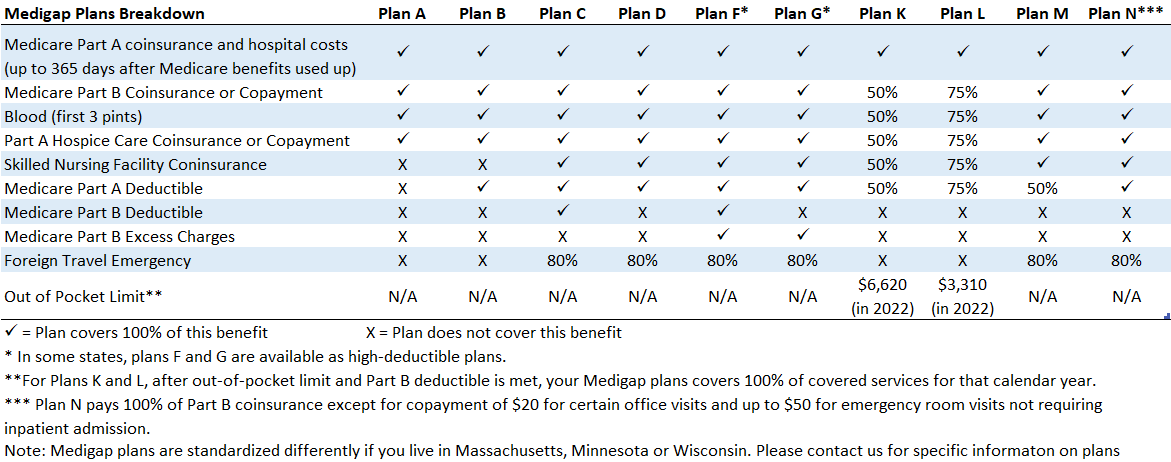

Types of Medigap Plans

There are ten types of Medigap plans available. Medicare has standardized the benefits available across each of the plans.

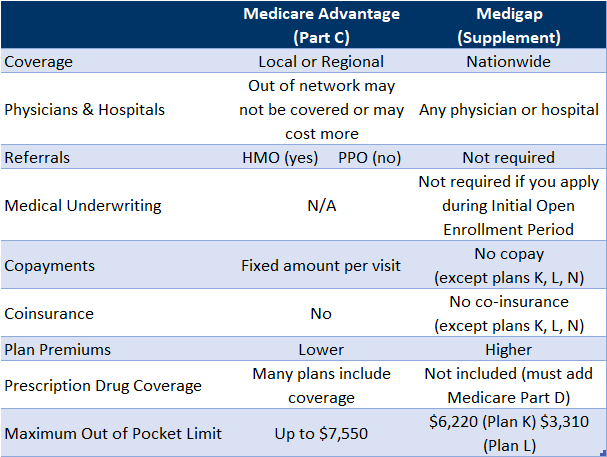

Medicare Advantage (Part C) vs. Medigap (Supplement)

Medical Underwriting

For coverage starting January 1, 2022, Medicare Advantage (Part C) plans accept all health conditions, including End-Stage Renal Disease (ESRD).

Medigap (supplement) plans may require medical underwriting; however, you can enroll without medical underwriting if you apply during your initial Open Enrollment Period. The initial Open Enrollment Period includes:

The three (3) months before your turn age 65

The month you turn 65

The three (3) months after your turn 65

Example: If your birthday is 07/15/1957 and you turn 65 on 07/15/2022, you can enroll from April-October 2022.

Important: To avoid coverage gaps, we recommend enrolling in Medicare at least one month prior to the month that you turn age 65. If you wait until the month you turn 65 to enroll, your coverage may be delayed. Additionally, if you do not enroll in Medicare Part B when you are first eligible, you may be subject to a late enrollment penalty.

How do I enroll?

To enroll in a Medigap plan:

Enroll in Medicare Part A and B (New to Medicare? Learn how to complete your initial enrollment here).

If you are new to Medicare, you must pay Part B monthly premiums (the standard premium in 2022 is $170.10 per month). You will also be responsible for paying a premium associated with your Medigap plan

Contact us to enroll in a Medigap plan to meet your needs

We offer supplement plans with leading carriers

Confused? Not sure which Medigap plan meets your needs?

Contact us for a free consultation with a licensed agent

(813) 761-3457

Robin@ZelinskyInsuranceGroup.com

By submitting your information to us, you expressly consent to receive emails and phone calls via automatic telephone dialing system or by artificial/re-recorded message, or by text message from licensed sales agents of Zelinsky Insurance Group, its affiliates, partner companies, and their partners at the telephone number above, including your wireless number if provided, message and data rates may apply. Furthermore, you understand that this consent to receive communications in this way is not required as a condition of purchasing any good or services. If you are Medicare-eligible, a licensed sales agent will contact you about Medicare-eligible, a licensed agent will contact you about Medicare plans by phone or email. Submitting your information to us does NOT affect your current Medicare Part A and Part B enrollment, nor will it enroll you in a Medicare Advantage Plan, Prescription Drug Plan, Medicare Supplement plan or other Medicare plan.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please visit Medicare.gov or

call 1–800-MEDICARE for information on all of your options and eligibility.

We are not affiliated with, connected to, or endorsed by the United States government or the federal Medicare program.