(813) 761-3457 (TTY: 711)

Medicare Overview

New to Medicare or changing your plan? We know how important having the right information is to making your healthcare decisions. At Senior Health Insurance Direct, we strive to provide you with the resources, information and tools to make the right decision for you and your family.

What is Medicare?

Medicare is a Federal health insurance program comprised of four parts: A, B, C, and D.

Original Medicare is a fee-for-service health plan comprised of parts A (hospital insurance) and B (medical insurance).

Medicare Advantage (Part C) plans are offered by private insurers and provide additional benefits and coverage. Medicare Part D covers prescription drug plans .

Who is eligible?

Individuals are eligible if they meet any of these criteria:

People age 65 or older

Certain individuals under age 65 with disabilities

People of any age that have End Stage Renal Disease (Kidney failure that requires dialysis or a transplant)

When does my coverage start?

Medicare coverage may start on the first day of the month that you turn 65.

For example, if your birthday is 07/15/1957, your Medicare coverage will start on 07/01/2022.

If your birthday falls on the first day of the month, your coverage will start one month before on the first. For example, if your birthday is 07/01/1957, your Medicare coverage will start on 06/01/2022.

You may also delay your Medicare coverage and select a different start date.

When can I enroll?

If this is your first time enrolling in Medicare:

The three (3) months before your turn age 65

The month you turn 65

The three (3) months after your turn 65

Example: If your birthday is 07/15/1957 and you turn 65 on 07/15/2022, you can enroll from April-October 2022.

Important: To avoid coverage gaps, we recommend enrolling in Medicare at least one month prior to the month that you turn age 65. If you wait until the month you turn 65 to enroll, your coverage may be delayed. Additionally, if you do not enroll in Medicare Part B when you are first eligible, you may be subject to a late enrollment penalty.

What does Medicare Cover?

Medicare Part A covers:

Inpatient hospital care

Skilled nursing facility care

Hospice care

Home health care

Medicare Part B covers services from providers outside of the hospital such as:

Outpatient doctor and other health care provider visits

Outpatient care

Home health care

Durable medical equipment (DME) such as wheelchairs and walkers

Preventive care such as screenings, vaccines, and imaging

Although Medicare pays for much, it does not cover all healthcare costs.

How do I start?

Your Medicare enrollment is managed through the Social Security Administration.

You can apply in one of three easy ways:

Online at https://secure.ssa.gov/iClaim/rib

Telephone at 1-800-772-1213 (TTY 711)

Visiting your local Social Security office. Find your local office at https://www.ssa.gov/locator/.

You must be enrolled in Medicare Part A for eligibility in certain optional plans such as Medicare Advantage (Part C) and Prescription Drug (Part D). Because individual circumstances and eligibility requirements vary, we offer free consultations to review your individual circumstances.

Although Medicare pays for much, it does not cover all healthcare costs

How much does Medicare cost?

For most individuals, Medicare Part A is free ($0 premium) if they (or another qualifying person such as a current or former spouse) worked 40 quarters (10 years) and paid Medicare taxes.

Medicare Part A (hospital coverage) includes a deductible of $1,556 (for 2022) that you must meet before it pays.

Medicare Part B (outpatient and DME) has a monthly premium that is based on your earnings. The standard premium for Medicare Part B in 2022 is $170.10/month. This monthly premium is paid even if you do not receive services.

Medicare Part B includes a deductible of $233 per year (for 2022) that you must meet before it pays.

Medicare Part B includes a 20% co-insurance. This means that you will pay 20% for Medicare-approved medical expenses after your deductible is met.

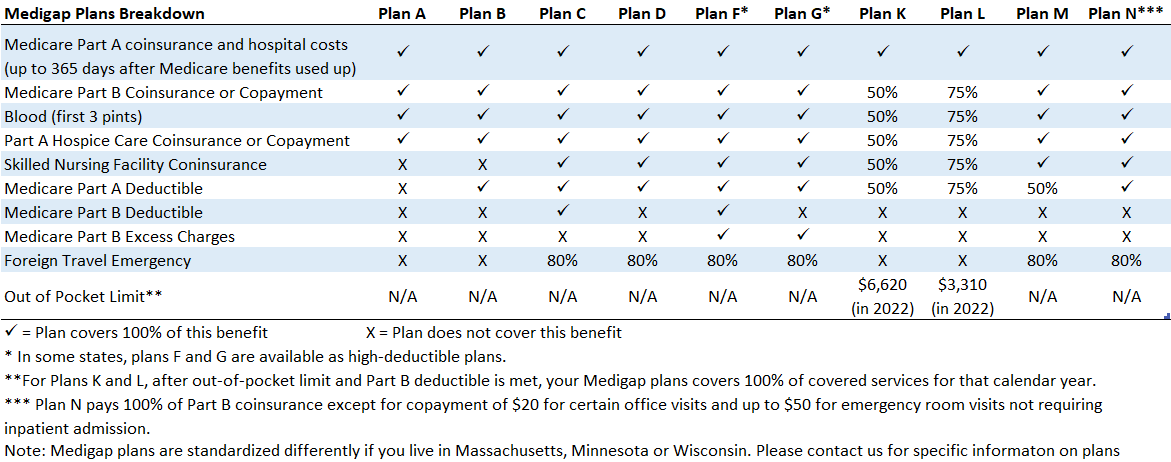

We offer additional plans such as Medigap that covers the costs and fees not covered by original Medicare (parts A and B). These plans can help bridge the 'gap' for services and fees not covered such as copayments, coinsurance and deductibles.

Additional Plans to Meet your Health Care Needs

Medicare Advantage (Part C), Prescription Drug (Part D) and Medigap Plans

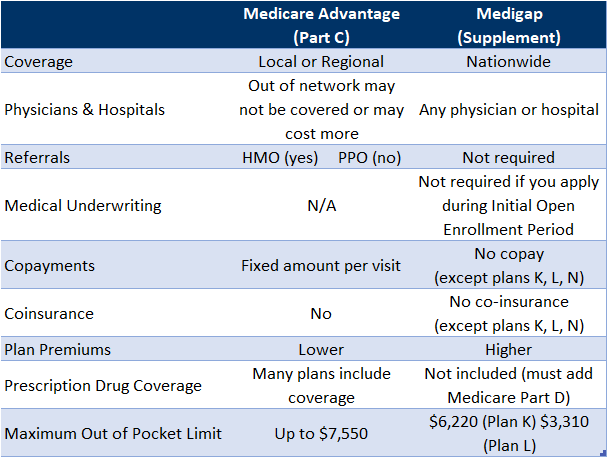

As an independent broker, Zelinsky Insurance Group is able to offer you a wide variety of plans and options from leading carriers. Our dedicated team is available to help you navigate your healthcare needs. Medicare Advantage (Part C) plans offer a wide range of coverage and services not offered by Original Medicare (Parts A and B) including vision, dental and wellness visits. Medicare Part D provides a wide range of prescription drug coverage. Medigap plans (supplement plans) cover your expenses such as deductibles, coinsurance and copayments not covered by original Medicare (Parts A and B).

Not sure where to start?

We know how important making the right insurance choices are for you and your family. At Senior Health Insurance Direct, we have a team of professional, licensed agents available to help you navigate our complex healthcare system.

We are here to help you, please give us a call at (813) 761-3457for your free consultation and assessment.

Medicare Advantage vs. Medigap

Medigap (Medicare Supplement) Plans

FAQs

Am I eligible?

Medicare is available to individuals that are age 65 or older, people under age 65 with certain disabilities, and those with End Stage Renal Disease (i.e. Kidney failure that requires dialysis or a transplant).

How do I enroll in Medicare Part A and B?

You can sign up for Medicare on the Social Security Administration website at https://secure.ssa.gov/iClaim/rib, via telephone at 1-800-772-1213 (TTY 711) or by visiting your local Social Security office.

How do I enroll in a Medicare Advantage (Part C), Prescription Drug (Part D) or Medigap plan?

We offer many supplement plans that include prescription drug coverage, vision, dental and other options not covered by Original Medicare. Please call us for your free consultation with a licensed agent at 1-855-688-1213.

Can I defer Medicare?

Yes, you are not required to enroll in Medicare and can defer your coverage. This may be done for a variety of reasons such as having current employer coverage.

Important: There can be penalties or gaps in coverage if you do not enroll in Medicare within certain timeframes after losing your stop working or lose employer coverage. Your individual circumstances are unique and may vary. Contact us at 1-813-761-3457 for a free assessment of your coverage and options.

Low Income Subsidy (Part D Drug Coverage)

The Low Income Subsidy (LIS) helps cover or lower the costs of Medicare prescription drug coverage including premiums, deductibles and copayments. Individuals may qualify for a full or partial subsidy. To review your options, please contact us for a free consultation with a licensed agent at 1-855-688-1213.

What is a premium?

A premium is a monthly cost you pay for coverage regardless of whether you receive care. Most individuals have a $0 premium for Medicare Part A.

What is a deductible?

A deductible is the amount you pay for covered services before your plan starts to pay. You must meet your deductible before your plan pays for covered services and care.

What is a copayment?

A copayment is a fixed dollar amount that you pay when you receive covered services.

What is coinsurance?

Coinsurance is a fixed percentage of costs that you pay. For Medicare Part B, you typically pay 20% for covered services.

Example: If a covered service costs $100, you pay a 20% coinsurance amount. In this example, Medicare pays $80 and you pay $20 ($100 x 20%).

Need help determining the plans that work for you?

Free Consultations with a Licensed Agent

(813) 761-3457

Robin@ZelinskyInsuranceGroup.com

By submitting your information to us, you expressly consent to receive emails and phone calls via automatic telephone dialing system or by artificial/re-recorded message, or by text message from licensed sales agents of Zelinsky Insurance Group, its affiliates, partner companies, and their partners at the telephone number above, including your wireless number if provided, message and data rates may apply. Furthermore, you understand that this consent to receive communications in this way is not required as a condition of purchasing any good or services. If you are Medicare-eligible, a licensed sales agent will contact you about Medicare-eligible, a licensed agent will contact you about Medicare plans by phone or email. Submitting your information to us does NOT affect your current Medicare Part A and Part B enrollment, nor will it enroll you in a Medicare Advantage Plan, Prescription Drug Plan, Medicare Supplement plan or other Medicare plan.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please visit Medicare.gov or

call 1–800-MEDICARE for information on all of your options and eligibility.

We are not affiliated with, connected to, or endorsed by the United States government or the federal Medicare program.